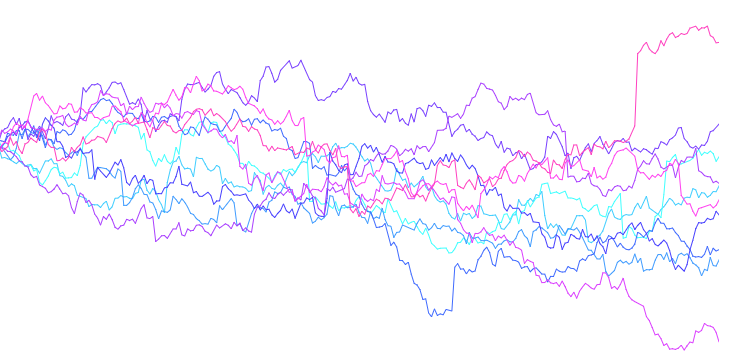

Financial markets are risky, and sometimes volatile. These two concepts are often

unjustifiably conflated. Any strategy that seeks to survive and extract long-term

alpha in a market must benefit from and not be harmed by uncertainty and

extreme events. This ancient philosophy is called antifragility - an operating

principle where one is exposed to the convex payoffs from extreme and chaotic events.

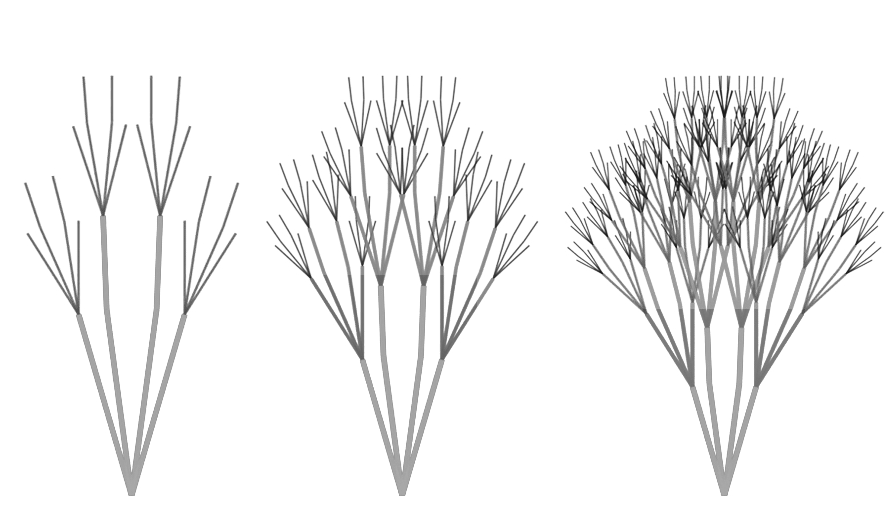

It is central to the idea of tail risk hedging. The principle can be applied at every

scale in the financial market which is why we refer to our approach as fractal.

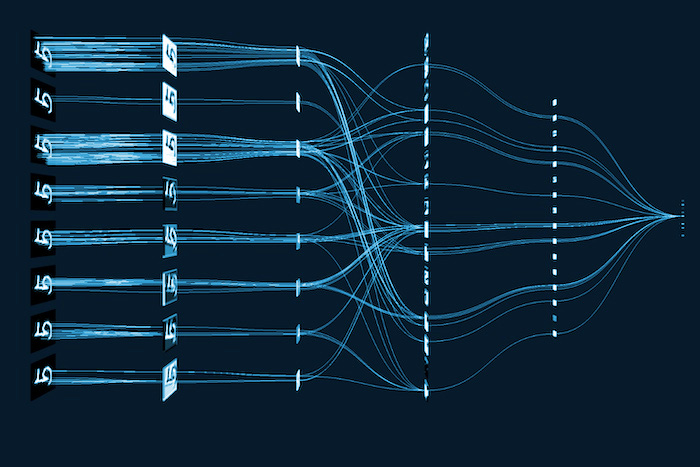

Our main strategy is to find and exploit structural fragilities in the macro- and

microdynamics of the market using our AI system's evolving understanding of these

dynamics by creating a risk-profile that thrives in volatile market conditions where

traditional hedge funds would not survive, allowing us to gain a massive long term edge.